In July 2025 the One Big Beautiful Bill Act was passed and became law, which includes a provision that may allow you to deduct interest paid on a loan used to purchase a qualified vehicle.1

This provision will be in effect on all new auto loans for qualified vehicles originated from January 1, 2025 through December 31, 2028.

Qualifications that need to be met in accordance with the IRS:1

- Loan originated between January 1, 2025 through December 31, 2028, for a new vehicle purchase. Vehicle leases and auto loans for used vehicles are not eligible.

- Vehicle was purchased to be used by the Taxpayer.

- Secured by a lien on vehicle.

- Vehicle must be for personal use. Business or commercial used vehicles do not qualify

- Vehicle is a car, minivan, van, SUV, pickup truck, or motorcycle that:

- Weighs less than 14,000 pounds

- Underwent final assembly in the United States

- Check the vehicle’s Monroney label while shopping. This label lists the assembly plant.

- Confirm the vehicle’s final assembly location using the Vehicle Identification Number (VIN). The National Highway Traffic Safety Administration website provides the NHTSA VIN Decoder

- Meet the IRS income thresholds for eligibility.

How to obtain your interest paid in 2025 include:

- Online Banking: Secure Login > Accounts > Tax Information > Click “Interest Paid” to open the dropdown menu > 2025 Interest column

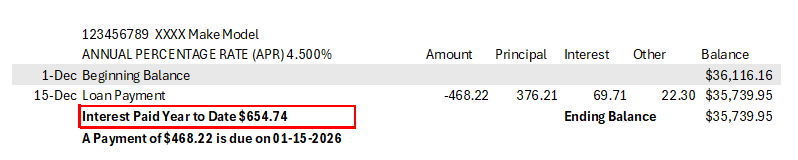

- December 2025 Account Statement: Locate the Loan Account > Interest Paid Year To Date will be detailed below payment details:

-

-

- NOTE: If your loan was paid in full in any month before December 2025, it will be on the statement for that month.

-

- If you need assistance obtaining this information, please call or text our Member Service team at 800-826-5465 or email [email protected].

Thinking of purchasing a new vehicle?

Before making a large financial decision, INOVA Federal encourages everyone to evaluate their current financial situation. With INOVA digital banking, a member can track their spending, assess their financial health, and view their credit score. Our website offers interactive, fully customizable Financial Calculators to help you make the most informed decision for you.

INOVA Federal is proud to offer competitive auto loan rates and convenient payment options. Visit our Auto Loans page for the latest loan interest rates and a link to apply.

Remember, at INOVA Federal your financial dreams are…

1Vehicle loan interest deductibility is subject to federal tax law, including the One Big Beautiful Bill Act, and individual circumstances. INOVA Federal Credit Union cannot provide members with tax advice. For eligibility requirements, please consult a tax professional to assist you with your loan qualification.